Property Tax Homestead Exemption Alabama . if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. Homestead exemption 1 is available to all citizens of alabama who. there are the four types of homestead exemptions: Visit your local county office to. The millage rate is the tax rate. (1) are over the age of 65 years, (2) are. learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. in alabama, you may be exempt from. Paying the state portion of real property tax if you: residential properties in alabama are assessed at 10% of the appraised value. homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except.

from www.exemptform.com

homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. in alabama, you may be exempt from. The millage rate is the tax rate. if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. there are the four types of homestead exemptions: Paying the state portion of real property tax if you: (1) are over the age of 65 years, (2) are. learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. Visit your local county office to. residential properties in alabama are assessed at 10% of the appraised value.

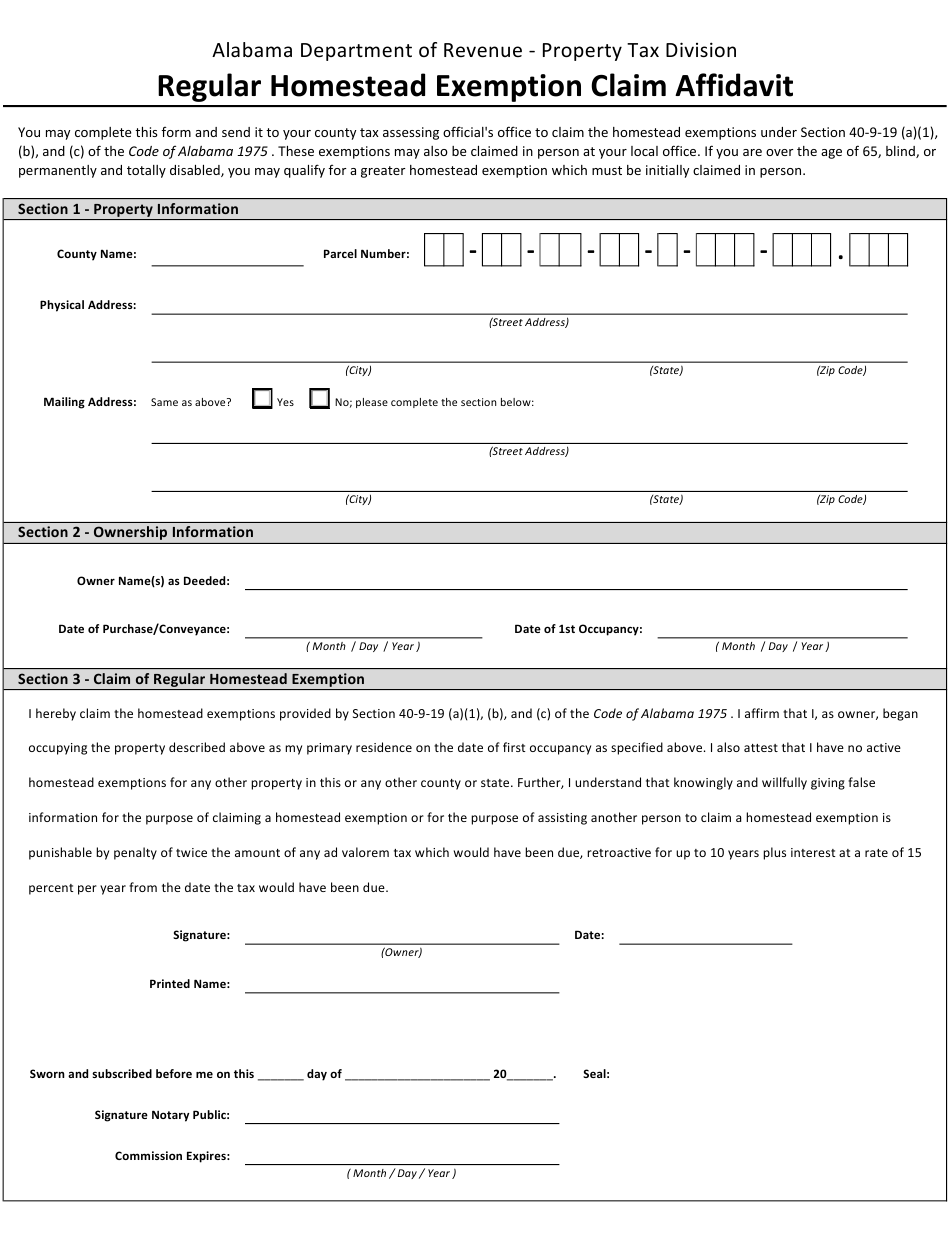

Jefferson County Alabama Property Tax Exemption Form

Property Tax Homestead Exemption Alabama in alabama, you may be exempt from. Homestead exemption 1 is available to all citizens of alabama who. learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. residential properties in alabama are assessed at 10% of the appraised value. homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. Paying the state portion of real property tax if you: (1) are over the age of 65 years, (2) are. Visit your local county office to. if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. in alabama, you may be exempt from. The millage rate is the tax rate. there are the four types of homestead exemptions:

From www.formsbank.com

Fillable Form Pt 38c Application For Property Tax Homestead Exemption Property Tax Homestead Exemption Alabama residential properties in alabama are assessed at 10% of the appraised value. Visit your local county office to. there are the four types of homestead exemptions: The millage rate is the tax rate. if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify. Property Tax Homestead Exemption Alabama.

From nishadkhanlaw.com

Homestead Exemptions In Florida Your Guide real estate lawyer Orlando Property Tax Homestead Exemption Alabama there are the four types of homestead exemptions: learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your. Property Tax Homestead Exemption Alabama.

From www.sprouselaw.com

Qualifying Trusts for Property Tax Homestead Exemption Sprouse Property Tax Homestead Exemption Alabama there are the four types of homestead exemptions: Paying the state portion of real property tax if you: Homestead exemption 1 is available to all citizens of alabama who. residential properties in alabama are assessed at 10% of the appraised value. homesteads of any residents of this state who are not 65 years of age or older. Property Tax Homestead Exemption Alabama.

From www.scribd.com

BCAD Homestead Exemption Form Tax Exemption Real Estate Appraisal Property Tax Homestead Exemption Alabama if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. Paying the state portion of real property tax if you: there are the four types of homestead exemptions: learn about the. Property Tax Homestead Exemption Alabama.

From progressive-charlestown.blogspot.com

Progressive Charlestown Another example of what a Homestead Property Property Tax Homestead Exemption Alabama Visit your local county office to. in alabama, you may be exempt from. Paying the state portion of real property tax if you: (1) are over the age of 65 years, (2) are. there are the four types of homestead exemptions: homesteads of any residents of this state who are not 65 years of age or older. Property Tax Homestead Exemption Alabama.

From www.homeatlanta.com

Cherokee County Property Tax Calculator Unincorporated. Millage Property Tax Homestead Exemption Alabama Paying the state portion of real property tax if you: there are the four types of homestead exemptions: if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. Visit your local county. Property Tax Homestead Exemption Alabama.

From www.exemptform.com

Fillable Form T 1058 Homestead Exemption Update 1996 Printable Pdf Property Tax Homestead Exemption Alabama The millage rate is the tax rate. Paying the state portion of real property tax if you: learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. residential. Property Tax Homestead Exemption Alabama.

From www.formsbank.com

Fillable Application For General Homestead Exemption printable pdf download Property Tax Homestead Exemption Alabama (1) are over the age of 65 years, (2) are. learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of. Property Tax Homestead Exemption Alabama.

From www.christybuckteam.com

Homestead Exemption Form, Don't to File in 2021! Christy Buck Team Property Tax Homestead Exemption Alabama homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. Homestead exemption 1 is available to all citizens of alabama who. Visit your local county office to. Paying the state portion of real property tax if you: if you’re 65 years or older, own. Property Tax Homestead Exemption Alabama.

From www.signnow.com

Homestead Exemption Complete with ease airSlate SignNow Property Tax Homestead Exemption Alabama learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. residential properties in alabama are assessed at 10% of the appraised value. Homestead exemption 1 is available to. Property Tax Homestead Exemption Alabama.

From www.readyfrontrealestate.com

HOW TO FILE FOR YOUR 2021 HOMESTEAD EXEMPTION Ready Front Real Estate Property Tax Homestead Exemption Alabama there are the four types of homestead exemptions: Homestead exemption 1 is available to all citizens of alabama who. if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. in alabama,. Property Tax Homestead Exemption Alabama.

From thebearofrealestate.com

2020 Homestead Exemption Reminders The Bear of Real Estate Property Tax Homestead Exemption Alabama Visit your local county office to. homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. The millage rate is the tax rate. Paying the state portion of real property tax if you: Homestead exemption 1 is available to all citizens of alabama who. . Property Tax Homestead Exemption Alabama.

From yourrealtorforlifervictoriapeterson.com

Homestead Exemptions & What You Need to Know — Rachael V. Peterson Property Tax Homestead Exemption Alabama Paying the state portion of real property tax if you: if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. The millage rate is the tax rate. in alabama, you may be. Property Tax Homestead Exemption Alabama.

From www.exemptform.com

Jefferson County Alabama Property Tax Exemption Form Property Tax Homestead Exemption Alabama homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. residential properties in alabama are assessed at 10% of the appraised value. learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. Homestead exemption 1 is available to. Property Tax Homestead Exemption Alabama.

From ceyopxll.blob.core.windows.net

Colorado Senior Property Tax Exemption Weld County at April Rowe blog Property Tax Homestead Exemption Alabama Visit your local county office to. (1) are over the age of 65 years, (2) are. if you’re 65 years or older, own and reside in your home, and have a net income of $12,000 or less, you may qualify for an exemption from paying the state portion of your property taxes. residential properties in alabama are assessed. Property Tax Homestead Exemption Alabama.

From dxofgdcoa.blob.core.windows.net

Mahoning County Property Tax Homestead Exemption at Jeffrey Estep blog Property Tax Homestead Exemption Alabama there are the four types of homestead exemptions: learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. in alabama, you may be exempt from. residential properties in alabama are assessed at 10% of the appraised value. The millage rate is the tax rate. homesteads of any residents of this. Property Tax Homestead Exemption Alabama.

From propertyappraisers.us

What Is Homestead Exemption Advantages & Filing in 2021 Property Tax Homestead Exemption Alabama learn about the alabama homestead exemption, its benefits for homeowners, eligibility, limitations, and exceptions, as. residential properties in alabama are assessed at 10% of the appraised value. homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. (1) are over the age of. Property Tax Homestead Exemption Alabama.

From greenbayhotelstoday.com

What is a homestead exemption? Alabama Department of Revenue (2023) Property Tax Homestead Exemption Alabama there are the four types of homestead exemptions: residential properties in alabama are assessed at 10% of the appraised value. homesteads of any residents of this state who are not 65 years of age or older are exempt from county levied property taxes, except. if you’re 65 years or older, own and reside in your home,. Property Tax Homestead Exemption Alabama.